The Idiot’s Guide To State Sponsored

#BogusSelfEmployment

What is Bogus Self-Employment?

Bogus self-employment is when your employer labels you as self-employed when you are actually and factually an employee.

Why would an employer want to label an employee as self-employed?

Employers label employees as self-employed in order to evade employers PRSI, Holiday pay, Maternity pay, Union recognition, Employee Rights etc. and also to evade legal responsibility for the actions or inactions of their employees in liability proceedings.

Is Bogus Self-Employment legal?

No, bogus self employment is illegal. It is social welfare fraud punishable by fines and/or imprisonment.

Why is Bogus-Self Employment social welfare fraud?

Your employment status, employee or self-employed, is entirely the responsibility of the Department of Employment Affairs and Social Protection (Social Welfare). The rate and class of PRSI paid by workers is entirely the responsibility of Social Welfare Department. Failure of an employer to pay employer’s PRSI is the legal responsibility of the Department Social Welfare.

Why does it matter?

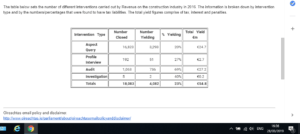

From official figures recently supplied to the Irish Congress of Trade Unions, the total loss to the exchequer from Bogus Self-Employment fraud, is conservatively estimated at more than ONE BILLION euro every year. This one billion figure is also in line with figures supplied to Paul Murphy TD by the Revenue Commissioners. The Revenue Commissioners have found bogus self employment to be as high as 69% in the Construction Sector. Bogus Self-Employment is costing at least 3 million euro each and every single day.

Who decides if you are an employee or self-employed?

Employment status (employed or self-employed), is NEVER a matter of choice. The facts are established first and then case law and precedents handed down by the Courts are applied to the facts to determine employment status. The Courts have handed down a number of ‘tests’ to be applied by the Department of Employment Affairs and Social Protection in order for the State to correctly determine employment status.

What is State Sponsored Bogus Self-Employment?

State sponsored Bogus Self-Employment is when the State deliberately ignores the case law, precedents and tests handed down by the Courts and instead facilitates and organises widespread bogus self-employment with employers in secret meetings, often with customized tax arrangements which label actual and factual employees as self-employed.

Why would the State want to label an employee as self-employed?

There are a number of reasons. Secret state aid to selected employers to create an uncompetitive advantage for selected employers. Secret state aid to selected employers as an incentive to create jobs. The State itself is one of the biggest abusers of employment status. To reduce the numbers on the unemployment register. To prevent workers accessing a host of social welfare entitlements such as pensions and Jobseekers payment.

This list is not exhaustive, there are many advantages for the State to engage in state sponsored bogus self-employment.

Is State sponsored Bogus Self-Employment legal?

No, state sponsored bogus self-employment is unlawful and illegal.

How SHOULD the State decide if you are an employee or self-employed?

The State, in particular the Department of Employment Affairs and Social Protection (Social Welfare), does not have nor take any preventative measures to ensure that workers are correctly classified. When, and only when, a worker believes themselves to have been incorrectly labeled as self-employed, does the Department of Employment Affairs and Social Protection have a role.

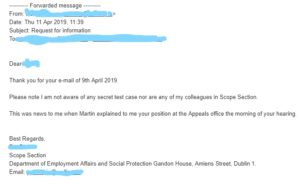

The worker writes to the Scope Section of the Department. The Scope Section launches an investigation. The functions of the Scope Section are to give decisions and information on the insurability of employment (Employee or Self-Employed) in accordance with the law. Scope decisions are legally binding decisions.

Since 1992, employers have been able to appeal Scope Section decisions to the Social Welfare Appeals Office on a point of fact or on a point of law. The Social Welfare Appeals Office is also an office of the Department of Employment Affairs and Social Protection. The Social Welfare Appeals Office can choose to hear the case ‘de novo’, which means that the Social Welfare Appeals Office can choose to ignore the Scope Section decision and instead hear the case as if for the first time. The Social Welfare Appeals Office must also make its decision in accordance with the law.

How DOES the State decide if you are an employee or self-employed in practice?

In practice, the Scope Section functions exactly how it should. It launches an investigation, establishes the facts and makes a decision in accordance with the law.

The Social Welfare Appeal Office DOES NOT function exactly how it should. It illegally creates its own ‘law’ by making determinations on the employment status of groups or classes of workers using precedents not handed down by the Courts. This is not in accordance with the precedents, case law and tests handed down by the Courts.

Does the Department of Employment Affairs and Social Protection know that the Social Welfare Appeals Office is creating unlawful precedents and is using those precedents to overturn Scope Section decisions which were made in accordance with the law?

Yes, the earliest record of unlawful precedents from the Social Welfare Appeals Office being known about comes from the Secretary General of the Department in 2000. The Secretary General not only admitted that he knew about the Social Welfare Appeals Office setting its own precedential test cases, he admitted that the Department accepted the precedential test cases and was using them to label thousands of workers as self-employed en masse.

Does the current Minister know that thousands of workers are being unlawfully labeled as self-employed by the Department of Employment Affairs and Social Protection using the unlawful precedents created by the Social Welfare Appeals Office?

Yes, the current Minister for Employment Affairs and Social Protection wrote in the Irish Independent on the 9th of April:

“I have asked my department to examine the possibility of the relevant legislation to allow deciding officers to make determinations on the employment status of groups or classes of workers who are engaged and operate on the same terms and conditions. “

With this statement, the Minister accepts and concedes that there is no legislation which allows the Social Welfare Appeals Office to make determinations on the employment status of groups or classes of workers, nor is there any legislation to allow the Department of Employment Affairs and Social Protection accept or use determinations on the employment status of groups or classes of workers made by the Social Welfare Appeals Office.

However, the Minister also stated:

“Currently such group or class decisions can only be carried out with the agreement of both employer and workers”

The true factual position is that such group or class decisions are unlawful in all circumstances. There is no legislation to allow employers or employees agree to class decisions. There is no legislation to allow the Minister or her agents to ASK employers or employees to agree to such decisions nor is there any legislation to allow the Minister accept such arrangements between employers and employees. The current Minister has deflected questions about such class decisions by claiming that employees ‘agreed’ to class decisions. The only records made public by the Department show that there WAS NO AGREEMENT from employees. Indeed, there is an abundance of evidence, including letters from Unions, which prove that employees were vehemently opposed to the unlawful class decisions which labeled them as self-employed.

Many workers who have been labeled as self-employed by the Department of Employment Affairs and Social Protection using the unlawful class precedents set by the Social Welfare Appeals Office have subsequently written to the Scope Section seeking to have their unlawful misclassification overturned.

Why hasn’t the Scope Section appealed the Social Welfare Appeals Office’s unlawful class decisions to the Higher Courts?

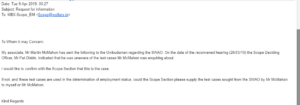

For more than 25 years, the existence of unlawful precedents created by the Social Welfare Appeals Office and accepted and used by the Department of Employment Affairs and Social Protection, was deliberately withheld from the Scope Section. It was only on the 26th of March this year that the Scope Section learned of these unlawful precedents:

The Scope Section has historically been denied legal representation in the Social Welfare Appeals Office by successive Ministers including Leo Varadkar who refused to allow the Scope Section be represented when he served as Social Welfare Minister.

The Scope Section finds itself in a very difficult position, it is the Minister who should be taking the Social Welfare Appeals Office to the Higher Courts, on the Scope Sections behalf, to have the unlawful precedents struck down. But, it is also the Minister who has accepted and used the unlawful precedents to label workers as self-employed en masse. In accepting the unlawful precedents, the Minister has undermined the lawful authority of her own Scope Section, the Courts and the Department of Employment Affairs and Social Protection.

What happens next?

I have written to the Ombudsman and asked the Ombudsman to compel the Department of Employment and Social Protection to release all their unlawful secret precedential test cases. I have also written again to the Public Accounts Committee and requested that they investigate State Sponsored Bogus Self-Employment as a matter of urgency.

What the Department of Employment Affairs and Social Protection does next is anybody’s guess.

The #tortoiseshack is entirely funded by patrons, become one at http://www.patreon.com/tortoiseshack